'Everything Is in Chaos': The Concert Business Stands to Lose Billions From Coronavirus

The abrupt reshuffling of major events like , SXSW, and Pearl Jam and Madonna’s shows due to is already devastating to the live — but by some predictions, we’re only seeing the start of the chaos.

Coronavirus-related event cancellations seem to be barreling in by the hour, and the $26 billion global live events industry is watching with bated breath. Several sources across the booking, management, and venues sectors either declined to comment to Rolling Stone on the subject because of the uncertainty around the matter, or say they do not yet have them in place. There’s also the issue of unpredictability: Government entities have not given a solid timeline estimate for how long the outbreak will remain a health crisis. Some healthcare officials are recommending a ban on large gatherings altogether.

“We’re preparing for everything although we’re hoping that if enough companies and organizations take mitigation tactics seriously, it could be contained by the summer,” Zena White, managing director of independent record label Partisan, whose artists include Laura Marling and Black Angels, tells Rolling Stone. “There’s a social responsibility to try to do what we can to protect the vulnerable, but no doubt this is a huge risk to artists and independent promoters’ businesses. No one has a crystal ball, but the longer we wait to take action, the less likely it will be contained soon.“

White notes that Partisan is “retooling all of our campaigns to ensure they’re robust in their online approach” — i.e. successful without a physical roll-out. From the label perspective, “we’re trying to innovate in new ways to keep business flowing,” she says. As an example: “Artists in China have been hosting festivals online from their bedrooms!”

Coachella’s postponement to October was widely rumored for the last week, but an official announcement didn’t come until Tuesday evening. Organizers had been having conversations with artist teams for days prior, according to sources close to the situation — and plenty of artists on the bill have fall tours planned. For mid-sized and smaller acts who depend on the visibility boost from playing Coachella, a six-month postponement could be particularly challenging.

“Everything is in chaos. I don’t think there’s any way people can hold back release schedules because of the ridiculous lead times, which in this day and age are still very much planned around vinyl turnaround times for vinyl being pressed.” — Laura Jane Grace, Against Me! lead singer

From indie DIY acts to major headliners, artists are also madly reshuffling plans. “Everything is in chaos,” Laura Jane Grace, the lead singer and guitarist of Against Me!, tells Rolling Stone. “Last time I talked to my European booking agent, before the virus, he was like ‘You need to get on top of things right now!’ and ‘Yeah, I’m already booking shows for November 2021.’ People operate on such a long lead that these things being canceled right now are … Well, things like SXSW are more than a year of advance planning. To re-plan them, re-figure out, re-schedule — you’re hoping more dominoes don’t fall and you won’t continue to have to cancel stuff. People are just waiting to see what happens.”

Grace adds that she and other artists expect the virus’s effects to reverberate beyond touring. “I don’t think there’s any way people can hold back release schedules because of the ridiculous lead times, which in this day and age are still very much planned around vinyl turnaround times for vinyl being pressed,” Grace says. “So if you’re a band and you’ve got a record that you have had on hold to be pressed for the last five months and it’s coming out a month from now… you are not going to change the release schedule or the touring schedule unless you absolutely have to. It’s like full years of planning that’ve gone into it.”

Promoters will likely feel the effect more than individual acts. Howard King, a managing partner at law firm King, Holmes, Paterno and Berliner LLC, said the virus’s impact could be potentially disastrous for all but the biggest players. For promoters that are not giants like Live Nation or AEG, “All these expenses they don’t get back could put them out of business,” King says.

“There’s not much organizers] can really do at this point,” one agency source says, adding that event attendees may only see an increase in hand sanitizer. “People know what risks they are facing by entering a concert space. The best ways to avoid getting sick are by washing your hands correctly and avoiding direct contact.”

Promoters and artists looking to protect their losses with insurance policies are somewhat out of luck. “Communicable disease coverage can be included, but by late January a separate and specific exclusion for coronavirus has been added to policies across the board,” says Cameron Smith, senior vice president for entertainment industry solutions at insurance provider HUB International. “So, if a festival or event purchased their cancellation coverage prior to that time, they may have limited coverage, but absolutely no one is covering coronavirus on newly bound policies.”

‘Greatest risk-management challenge since the financial crisis’

The coronavirus is one of the largest economic challenges of the decade, analysts say. Kristen Jaconi, director of the Risk Management program at the University of Southern California’s Marshall School of Business, says the lack of knowledge and data on the virus has made it difficult for companies to push forward. Industries that operate on a global level, such as technology, retail, and live music, face particular challenges when it comes to the travel that’s so crucial to their business.

“I think this is the greatest risk management challenge since the financial crisis,” Jaconi tells Rolling Stone. “We don’t know its impact yet, we don’t know if we’ll be able to contain this or not. So for a lot of companies, this is the worst risk management challenge they’ve faced since the crash in 2008.”

And accurate data is still far out of reach. “You’re weighing the risks to public health and safety, there’s nothing more paramount than that,” Jaconi said. “That’s the thing entertainment and sports are weighing right now. We don’t have the best data.” Analysts told Forbes last week that the music industry could lose as much as $5 billion — the same amount as the projected loss for the film industry, which has already pushed back several high-profile movie production schedules and premieres, like the one for the latest Bond film No Time to Die.

“The industry, in the aggregate, is equipped to handle these black swan events, however larger operators are generally better suited to weather the economic storm,” says Kevin Kennedy, an industry analyst at IBISWorld. “Overall, the negative economic impact of the virus will be especially severe for smaller-scale operators that cannot effectively manage the risk of potential cancellations or postponements.”

In the next few months, the live music industry will face further significant economic impact, Kennedy says with the timing of the outbreak coming just as the bulk of festival season approaches. “Given it’s late in the planning cycle, the potential losses due to cancellations or postponement are comparatively more severe than if this situation would have developed some time prior.” He says will play a role in further economic downturn, and with the live music business relying so heavily on attendees spending discretionary income on shows, a downturn will more heavily impact live music than industries offering essentials. Still, he says, the live music business should recover.

“However, an economic slowdown that negatively impacts income levels would more substantially impact the industry, as concert purchases are discretionary in nature,” he says. “Since Covid-19 could stand as a contributing factor to this event, understanding how this virus affects the global economy is important in evaluating any industry’s performance moving forward.”

Generally speaking, music festivals serve as massive revenue sources for their local economies. SXSW events — including the music and film festivals, interactive conferences, panels, a gaming expo and more — invited more than 417,000 people to Austin last year. The conference went on to bring in $356 million to the city, festival representatives said. For smaller businesses like boutique hotels and restaurants in festival areas, revenue from nearby music events can determine the majority of the business’s overall earnings for the year.

Coachella is the second-largest festival in the United States, attracting a total of around 600,000 people in 2019. (Summerfest in Milwaukee, which pulled in more than 750,000 attendees last year, is the biggest.) In 2019, Jim Curtis — the City Services Manager of Indio, where Coachella takes place — told NBC that $1.4 billion in profits was projected that year from the Coachella and Stagecoach festivals. According to NBC, more than half of that, $805 million, was expected to go to the Coachella Valley, while the city of Indio was expected to receive approximately $212 million. In a place like the greater Palm Springs area, part of that money supports the higher amount of healthcare professionals necessary for a retirement destination made largely of senior citizens.

The hardest-hit group in the industry may be the tour managers, soundboard operators, and other venue employees or crew members who rely on tour income and may not be making any salary at all without working on shows. “The biggest concern for someone like myself is that both of the bands I work with are coming out of their slow season,” says Jeff Pereira, the tour manager for Jimmy Eat World and Angels and Airwaves. “You do your best to budget for the time off and then some but weeks of unexpected down time can be a real issue. With so many touring and production people facing the same thing we all end up fighting to get on the few tours that may still be happening or having to look for local work outside of our fields.”

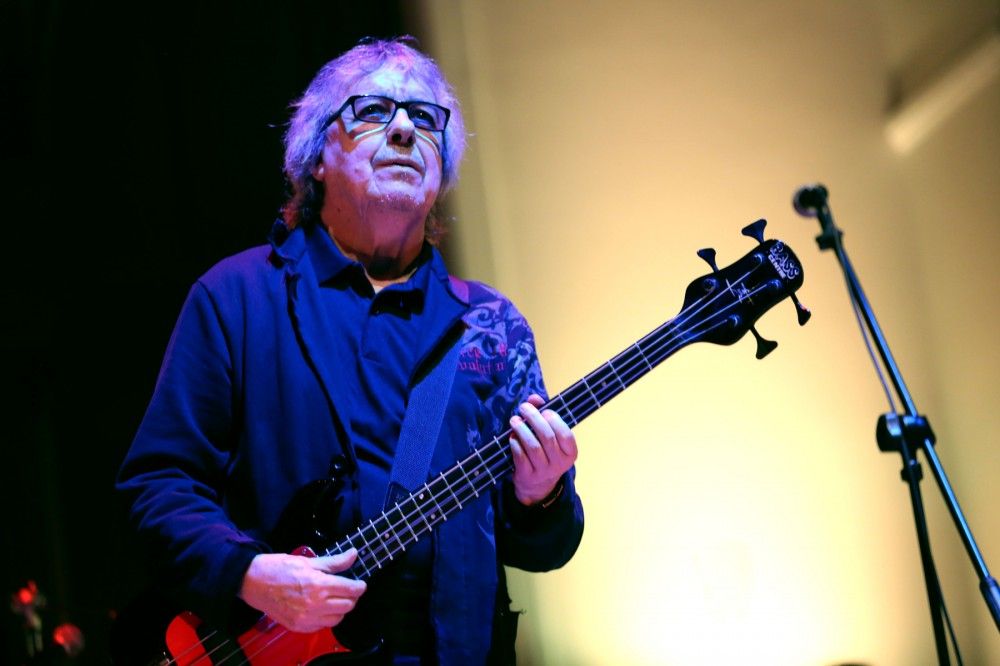

“Once, our band all had the flu, shitting and puking nonstop, and we still showed up and played. But with this situation, there are not even shows to show up to.” — Brian Cook, Russian Circles bassist

Brian Cook, bassist of instrumental group Russian Circles, had to cancel a six-week European tour this week because all the countries involved placed restrictions on large gatherings. “We’ve played through a lot of things,” he says. “A whole six-week tour with a guitar player with a broken thumb; we had a truck plow into us in the highway once and destroy half our gear. Most artists we know will play through almost everything — I know people who played with back pain when they can barely stand up. Once, our band all had the flu, shitting and puking nonstop, and we still showed up and played. But with this situation, there are not even shows to show up to.”

“The business has to keep moving as the records have been made and fans are all still there and waiting so we’re keeping all our meetings just moving to video chats from our homes,” White, the label director, says. “Being as prepared for every outcome as possible is the biggest priority as when there is uncertainty you have to keep your decision-making quick and nimble.”

The cost to concertgoers?

Fans are feeling the cancellations in their wallets, as well. In 2019, the average nightly hotel rate for SXSW-booked rooms was $365, and the average length of stay exceeded five nights. That means in many cases, individuals spent close to $2,000 on accommodations alone. After last week’s cancellation, SXSW told its badge-holders it would allow attendees to defer their tickets for the 2021, 2022 and 2023 festivals; a spokesperson for the festival tells Rolling Stone it will look for ways to add “extra benefits” and additional value to these deferred registrations.

Miami’s postponed Ultra Music Festival sent ticket-holders an email Monday night confirming their tickets would be valid for the next two iterations of the festival, offering detailed a package of add-ons and extras they could receive because of last week’s cancellation. But while the attendees would get, among other things, a free ticket to any Ultra World Wide event, an exclusive extra DJ set before next year’s festival, and 50% off purchases — as long as they didn’t exceed $250 — refunds were absent from the language, and ticket-holders wasted no time expressing their outrage on social media.

For SXSW, the standard price for a wristband is $225. A general music badge is $1,395, while platinum badges cost even more. If an attendee chooses to get a music badge and stay at a hotel, that could cost around $3,400, and that’s not including any budget for travel or incidentals. Some fans spend months saving up to attend events like SXSW — proving, to analysts’ point, the potential of the live events business to rebound after the virus crisis subsides.

“Music specifically is an irreplaceable part of human culture and consumers will continue flocking to venues and events when deemed safe to do so,” Kennedy says.

Additional reporting by Amy X. Wang